Think of your customer list as a blurry, black-and-white photo. You can make out the basic shapes, but the important details are missing. B2B data enrichment is the process that brings that photo into sharp, high-definition color. It adds layers of crucial context to the basic information you have, turning raw data into real intelligence for your revenue and go-to-market teams.

What B2B Data Enrichment Really Means

At its heart, B2B data enrichment is about taking your existing—and often incomplete—customer data and fleshing it out with information from reliable third-party sources. It’s about moving beyond just a name and an email address to build a complete, multi-dimensional view of your ideal customers.

Here’s another way to look at it: you have a single puzzle piece, maybe from a new lead who filled out a form. Enrichment is what provides all the surrounding pieces, finally revealing the bigger picture. It answers the critical questions your sales and marketing teams are asking every single day.

Moving from Raw Data to Actionable Insight

Without enrichment, your CRM can quickly become a graveyard of outdated and incomplete records. This leads directly to wasted effort, generic outreach, and a lot of missed opportunities. On average, companies lose millions each year due to poor data quality—a problem that enrichment is designed to solve.

Let’s look at how this plays out in the real world. This table shows the “before and after” of a simple lead record.

From Raw Data to Enriched Insights

This table illustrates the transformation of a basic lead record before and after B2B data enrichment, highlighting the added value.

| Data Point | Before Enrichment (Basic Lead) | After Enrichment (Actionable Profile) |

|---|---|---|

| Name | Jane D. | Jane Doe |

| Company | Acme Inc. | Acme Inc. |

| jane.d@acme.com | jane.d@acme.com | |

| Title | Unknown | VP of Marketing |

| Industry | Unknown | SaaS (Software as a Service) |

| Company Size | Unknown | 501-1,000 Employees |

| HQ Location | Unknown | San Francisco, CA |

| Tech Stack | Unknown | Salesforce, Marketo, Google Analytics |

| Recent Funding | Unknown | Raised $50M Series B (3 months ago) |

As you can see, the “after” column isn’t just more data—it’s a story. It tells you who Jane is, what her company does, and what tools they use. This is the kind of information that fuels truly effective go-to-market strategies.

By appending these key attributes, you unlock powerful new capabilities:

- Smarter Segmentation: You can now group accounts by industry, company size, or even the technology they use, allowing for hyper-targeted campaigns.

- Powerful Personalization: Instead of a generic email, you can reference Jane’s specific role or her company’s recent funding round.

- Accurate Lead Scoring: You can automatically prioritize leads that perfectly match your ideal customer profile (ICP).

- Increased Efficiency: Your sales reps spend less time digging for information and more time having meaningful conversations.

This shift from guesswork to data-driven precision is why the B2B data enrichment market is booming. Forecasts project its value to grow from around $5 billion in 2025 to nearly $15 billion by 2033. This isn’t just a trend; it’s becoming a foundational part of modern revenue operations. You can find more detail on this growth at marketreportanalytics.com.

At its core, data enrichment is about one thing: certainty. It provides the confidence to know you’re talking to the right person, at the right company, with the right message, at exactly the right time.

This process bridges the gap between the sparse data you collect upfront and the rich context you actually need. As we’ll dig into next, getting this foundational step right is what sets the stage for every successful sales motion and marketing campaign that follows.

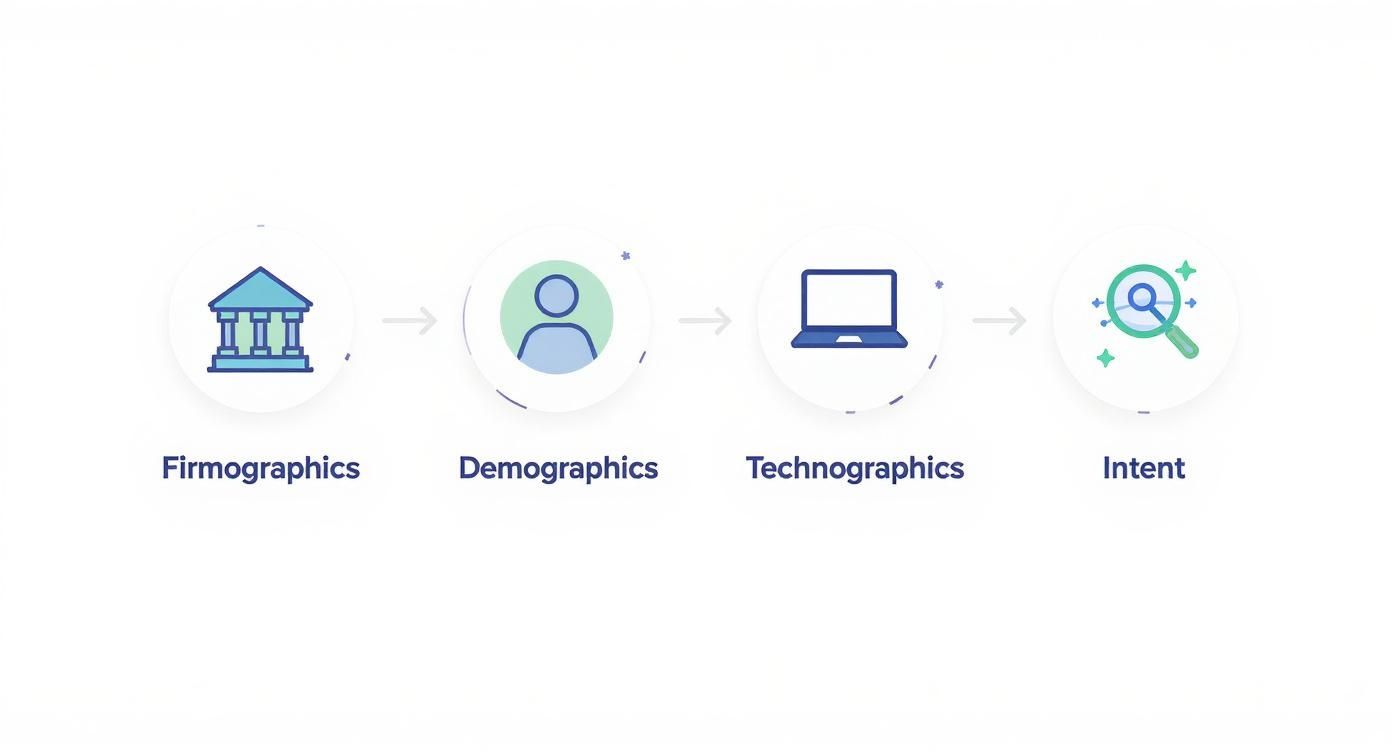

Getting to Know the Four Pillars of B2B Data

Great B2B data enrichment isn’t just about grabbing more data—it’s about strategically adding the right data to paint a complete picture of your customer. To really nail this, you have to understand the four core pillars that hold up any solid customer profile.

Think of these pillars as different camera angles on your customer. Each one shows you something unique, and when you put them all together, you get a full-color, 3D view that can steer your entire go-to-market strategy.

Firmographics: The Company’s DNA

First up, you’ve got firmographics. This is basically the “demographics” for a company. This data lays out the basic facts about an organization, giving you a quick snapshot of its size, shape, and structure. It answers the simple but crucial question: “What kind of company are we looking at?”

Firmographic data is the absolute foundation for segmenting your market and carving out sales territories. It makes sure your team isn’t chasing ghosts but is focused on accounts that actually fit your ideal customer profile (ICP).

A few key firmographic points are:

- Industry: What world do they live in? (e.g., SaaS, Healthcare, Manufacturing)

- Company Size: How many people work there? This is often a huge clue about their budget and how complicated their buying process might be.

- Annual Revenue: What’s their financial firepower?

- Geographic Location: Where are their headquarters and other key offices?

Knowing a prospect is a 500-person SaaS business in North America with $50M in annual revenue is a world away from just having a company name. That info alone helps you qualify them and shape your first conversation.

Demographics: The People Inside

While firmographics tell you about the company, demographics zoom in on the individuals working there. This data is all about understanding the actual people you’re trying to sell to, so you can stop sending generic emails and start having real, personalized conversations.

Demographics turn a faceless account into a network of actual humans. It’s the difference between selling to “Acme Corp” and building a relationship with “Jane Doe, the VP of Marketing at Acme Corp.”

This pillar helps you figure out: “Who holds the keys to the kingdom?”

Common demographic details include:

- Job Title: Are they a “Director,” “VP,” or a “C-level” executive?

- Seniority Level: How much pull do they really have when it comes to making a purchase?

- Function or Department: Are they in Marketing, Sales, Engineering, or somewhere else?

With this data, your sales reps stop wasting time talking to the wrong people. They can map out the buying committee and get straight to the champions and budget holders who can actually get a deal done.

Technographics: Their Digital Toolbox

Next, there’s technographics, which tells you what technologies a company is using. Think of it as getting a peek inside their digital toolbox to see the software and hardware they use to run their business. This gives you incredible insight into their current workflows, challenges, and priorities.

This data is gold for competitive intel and spotting integration opportunities. It helps you answer the strategic question: “What tools are they already invested in, and where are the gaps we can fill?”

For example, if you see a prospect is using a direct competitor, you know to lead with your key differentiators. If they’re using a tool that works well with yours, you can pitch them on a seamless integration.

Intent Data: The Buying Signals

Last but not least is intent data, the most dynamic pillar of them all. This is all about capturing the digital breadcrumbs that show a company is actively researching solutions like yours. It tracks online behavior, like when someone from an account downloads a whitepaper, searches for specific keywords, or binges content on a certain topic.

Intent data is the closest thing we have to a crystal ball in sales and marketing. It helps you find and prioritize accounts that are in-market right now, turning a cold call into a warm, relevant conversation. It answers the most important question of all: “Who should we be talking to this week?”

By following these digital footprints, you can engage prospects right when their interest is highest, which massively boosts your odds of starting a real conversation.

How to Build Your Data Enrichment Engine

Building a top-notch B2B data enrichment engine isn’t just about plugging in a new tool and hoping for the best. It’s about architecting a system that delivers clean, trustworthy data right where you need it, exactly when you need it. For those of us in RevOps, getting a handle on the technical side of things is what separates reactive data cleanup from proactive, scalable intelligence.

So, let’s pop the hood and see how it all works.

This infographic breaks down the four foundational pillars of B2B data—firmographics, demographics, technographics, and intent. These are the building blocks for any solid enrichment strategy.

Think of each pillar as a different lens for viewing your customer. A well-built engine makes sure these lenses are always in focus by constantly updating and integrating the data.

Capturing Real-Time Changes with CDC Pipelines

Here’s the thing about your CRM data: it’s never static. People get promoted, companies get acquired, and new software is adopted every single day. If you’re still relying on traditional batch updates—where data gets refreshed once a day or even once a week—your teams are always a step behind.

This is where Change Data Capture (CDC) completely changes the game.

Imagine CDC as a tiny security camera pointed at your database. Instead of taking a full snapshot every hour, it just records the changes the moment they happen. When a contact’s job title gets updated in your CRM, a CDC pipeline instantly flags that one event and sends it down the line for enrichment.

For GTM teams, this real-time flow is huge. It means lead routing, scoring, and personalization are all running on the absolute latest information, not data that went stale hours or days ago.

Creating a Single Source of Truth

With all this data flying around, where should it all live and get processed? More and more, the answer is a central data warehouse like Snowflake, BigQuery, or Redshift. Syncing your CRM (think HubSpot or Salesforce) to your warehouse establishes a single, durable source of truth for every scrap of customer information.

This setup has some serious perks:

- Decoupling Systems: Your CRM can go back to being a great CRM instead of a clunky data processor. This prevents slowdowns and keeps your core system of record clean.

- Historical Analysis: A warehouse can keep snapshots of your data over time, letting you track trends and changes in a way most CRMs just can’t handle.

- Scalability: Warehouses are built to chew through massive datasets and complex queries without batting an eye, so your enrichment engine can grow right alongside your business.

This warehouse-first approach is the bedrock of a modern data stack, and a service like RevOps JET can build and manage those sync pipelines to get you there faster.

Designing a Flexible Data Schema

Your data schema is basically the blueprint for how your data is organized. A bad schema is rigid and brittle—it shatters the second you try to add a new data source or track a new attribute. A good schema, on the other hand, is flexible and designed for the real world.

The key is to create a structure that keeps your raw, messy source data separate from the clean, “production-ready” data your teams actually use. This usually means creating different layers or models inside your warehouse.

A layered data schema works just like a professional kitchen. You have a “staging” area for raw ingredients (the raw data), a “prep” area where you clean and combine everything (transformation logic), and a “serving” station with the final, polished dishes (the production data).

This separation is your safety net. If a raw data source suddenly changes its format, it won’t instantly break the dashboards your CEO relies on. You can contain the mess and fix it in the “prep” area without anyone even noticing.

Transforming Raw Data into Usable Insights

Once your data lands in the warehouse, it’s rarely ready to use. Job titles are all over the place (“VP Marketing” vs. “Marketing Vice President”), company names have tiny variations, and state fields might be abbreviated one time and spelled out the next. This is where data transformation comes in.

This is the make-or-break step where you clean, standardize, and model all that raw information into a reliable asset. Tools like dbt (Data Build Tool) are perfect for this, letting engineers write simple SQL-based rules to:

- Standardize job titles into consistent levels and functions.

- Normalize revenue figures into a single currency.

- Map industry fields to a clean, standardized list.

This is what ensures that when you go to build a segment or pull a report, you’re always comparing apples to apples.

Why Pipeline Observability Is Non-Negotiable

Last but not least, how do you know if your beautiful new engine is actually running smoothly? That’s the job of pipeline observability. It’s the collection of monitors, logs, and alerts that scream at you when something breaks. Without it, you could be silently pumping bad data into your CRM for weeks before anyone realizes.

Good observability tracks everything from data freshness and volume to schema changes. If a third-party API suddenly stops sending data or changes a field name, your team gets an alert right away. This proactive monitoring is your best defense against the sneaky data quality gremlins that erode trust and lead to bad business decisions.

A Few B2B Data Enrichment Best Practices You Can’t Ignore

Look, having a powerful data enrichment engine is great, but it’s only half the battle. If you’re not careful, you’ll just end up adding more noise to your CRM. To get real value, you need a smart, strategic approach. These practices are your playbook for making sure every dollar you spend on data actually helps your go-to-market teams win.

It all boils down to one simple idea: focus. The goal isn’t to Hoover up every data point you can find on a company. It’s about pinpointing and filling in only the fields that directly fuel your sales and marketing plays.

Prioritize Strategically to Get the Best Bang for Your Buck

Start by looking at your Ideal Customer Profile (ICP). What are the absolute, must-have details that tell you an account is a good fit? Is it their employee count? The specific tech they use? Where they’re located?

When you zero in on these high-impact fields, two great things happen:

- You save money. Most data providers charge you based on how much you ask for. By only enriching what you truly need, you stop wasting your budget on data points your teams will never even look at.

- You improve focus. A clean, relevant dataset is so much more useful for a sales rep than a bloated record overflowing with useless information. It keeps them locked in on what actually matters for qualifying and personalizing their outreach.

The big idea here is to treat data enrichment like a scalpel, not a sledgehammer. Answer your most important business questions first, and only expand once you’ve proven the initial value.

Keep Data Compliance and Ethics Front and Center

In this day and age, how you get your data is just as important as the data itself. Using ethically sourced, compliant data isn’t just a good idea—it’s non-negotiable. With regulations like GDPR in Europe and CCPA in California, the bar for data privacy is high, and the penalties for getting it wrong are steep.

This means you absolutely have to partner with data vendors who are upfront about their sourcing methods. They need to guarantee their data aligns with these legal frameworks. Always, always ask potential partners about their compliance—it’s a critical piece of due diligence that protects you from some serious legal and reputational headaches.

Fight Back Against Data Decay with Continuous Enrichment

Your CRM data has an expiration date. People switch jobs, companies get bought, and tech stacks change. This constant churn is what we call data decay, and it’s a massive thorn in the side of every revenue team.

Industry research shows that a whopping 25-30% of B2B data goes stale every single year. Think about that. Your once-pristine database is slowly becoming less and less reliable. A one-and-done data cleanup project is like trying to mop the floor during a flood; the problem will be back before you know it. You can learn more about the real impact of data decay at martal.ca.

The only way to win this fight is to move from manual, one-off updates to a system of continuous, automated enrichment. This means putting systems in place that automatically refresh your records on a regular schedule, so your teams are always working with the freshest information possible.

The Age-Old Question: Build vs. Buy?

Finally, every company eventually hits the classic “build vs. buy” crossroads. Do you try to spin up a custom data enrichment solution in-house, or do you find a specialized partner? The right answer really comes down to your team’s resources, skills, and strategic goals.

| Factor | Building In-House (Build) | Partnering with a Vendor (Buy) |

|---|---|---|

| Control | You have complete control over the logic and data sources. | You have less direct control and rely on the vendor’s roadmap. |

| Cost | High upfront investment and ongoing engineering costs. | Predictable subscription fees (OpEx). |

| Speed | Slow to get off the ground; eats up a ton of dev time. | Much faster deployment; you can see value in weeks. |

| Maintenance | Needs a dedicated engineering team just to keep it running. | The vendor handles all the maintenance and updates for you. |

For most companies, building a solid, scalable enrichment pipeline from scratch is a huge distraction. It pulls valuable engineering talent away from working on your actual product. This is where partnering with a specialized vendor or a service like RevOps JET can be a game-changer. It gets you expert-managed infrastructure up and running fast, without the long-term maintenance headache, letting your team focus on strategy instead of plumbing.

How to Measure the ROI of Your Data Strategy

Investing in B2B data enrichment feels like a smart move, but how do you actually prove its value to your CFO or leadership team? The trick is to stop talking about “clean data” and start connecting your efforts directly to the bottom-line numbers everyone cares about.

A great data strategy does more than just tidy up your CRM records; it makes your entire go-to-market engine run better. To prove it, you need to paint a clear “before and after” picture using concrete metrics that scream return on investment.

Core Metrics to Track

The best way to build your case is to benchmark everything before you flip the switch on a continuous enrichment program. Once it’s running, track those same metrics to show a direct cause-and-effect relationship.

- Lead-to-Opportunity Conversion Rate: This is the big one. Enriched leads are better qualified and get to the right sales rep faster, which means more of those first calls turn into real, qualified pipeline.

- Time to Qualify Leads: How much time does your SDR team waste digging for basic info on a new lead? With enrichment, they can stop being researchers and start being sellers, cutting that qualification time down dramatically.

- Sales Pipeline Velocity: This tells you how fast deals are moving from one stage to the next. Better data means more relevant conversations and fewer stalled deals, speeding up the entire sales cycle.

- Marketing Engagement Rates: When your marketing campaigns are powered by rich, accurate data, personalization gets a serious upgrade. Keep an eye on email open rates, click-throughs, and webinar sign-ups for audiences built with those new data points.

The Real-World Impact of Enriched Leads

The difference between an enriched lead and a raw one isn’t just a talking point—it’s something you can see in the numbers. Enriched leads consistently outperform, converting at rates 20-30% higher than their unenriched counterparts. This translates directly to a healthier pipeline and more revenue.

It’s no wonder that nearly 75% of B2B companies now see data enrichment as essential to their marketing success. If you want to dive deeper into the data, the full research on lead enrichment from MarketsandMarkets is a great place to start.

Let’s walk through a quick, real-world example.

Before Enrichment: Your SDRs get a list of 1,000 raw leads. After hours of manual research, they manage to book 50 meetings, and 10 of those eventually become qualified opportunities. That’s a lead-to-opp conversion rate of 1%.

After Enrichment: Now, those same 1,000 leads come in fully enriched. Your team instantly knows who to prioritize. Their outreach is hyper-relevant, so they book 80 meetings, and 25 of those turn into qualified opportunities. Your conversion rate just shot up to 2.5%.

That’s not a minor improvement; it’s a 150% increase in pipeline from the exact same lead flow.

When you can present this kind of clear, quantifiable proof, your case for data enrichment becomes bulletproof. You’re no longer just talking about cleaning up messy records—you’re showing how you’re building a more efficient and predictable revenue machine.

Your Data Enrichment Implementation Roadmap

Alright, this is where the rubber meets the road. A great B2B data enrichment program isn’t just a happy accident; it’s the result of a clear, logical plan that takes you from initial idea to real-world execution. Let’s walk through the roadmap to get your initiative off the ground and adding value fast.

Think of this less like a one-and-done project and more like building a permanent, powerful capability for your entire revenue team. Each step is a building block, creating a solid foundation for a smarter, data-driven GTM engine.

Phase 1: Define Your Goals and Audit Your Data

Before you can start adding new data, you have to know what you’re working with. The first move is always a deep-dive audit of your CRM and marketing automation platform. What are the most painful gaps? Is it missing job titles, fuzzy company sizes, or a total lack of industry information?

Once you’ve identified the gaps, you need to connect them directly to your business goals. Don’t just say you want “better data.” Get specific. Define exactly what success will look like.

- Goal Example 1: “We need to nail lead routing. That means enriching every single new lead with accurate

IndustryandEmployee Countdata within five minutes of entry.” - Goal Example 2: “Our ABM campaigns need more bite. We’ll personalize outreach based on the prospect’s

Tech Stackto drive higher engagement.”

This kind of clarity turns a vague concept into a rock-solid plan. It also makes choosing the right tools a whole lot easier.

Phase 2: Select Tools and Integrate Your Stack

With your goals clearly defined, you can start looking at vendors. Find partners who specialize in the exact data points you need and, just as importantly, offer clean, simple integrations with your existing tech stack—especially your CRM. That connection has to be rock-solid.

Integration is way more than just flipping a switch. You need to map fields correctly, set up the rules for when enrichment happens (like on new lead creation), and rigorously test the entire flow in a sandbox environment. The last thing you want is to pollute your live production data with errors. A rushed integration can easily create more chaos than it solves.

An enrichment tool is only as good as its integration. A clunky, unreliable connection will undermine your entire strategy, creating data silos and frustrating your end-users. Aim for a system that feels like a native part of your CRM.

Phase 3: Establish Ongoing Maintenance

Here’s a hard truth: data enrichment isn’t a one-time fix. It’s a continuous process. Your data starts getting stale the moment it’s collected. To combat this data decay, you have to set up an automated, ongoing maintenance plan to keep your records fresh.

This means scheduling regular data refreshes and putting monitoring in place to catch problems before they ever affect your sales and marketing teams. This commitment to upkeep is what separates a short-term cleanup project from a long-term strategic asset.

For a lot of teams, building and maintaining these complex data pipelines is a massive drain on precious engineering resources. Instead of sinking months into building infrastructure, a managed service like RevOps JET can act as your accelerator. A service can deliver a pre-built, expert-managed engine, helping your team see results in weeks, not quarters. This frees you up to focus on strategic wins instead of getting bogged down in technical headaches.

Key Takeaways

Here are the essential insights from this guide to help you build a winning data enrichment strategy:

- B2B data enrichment transforms incomplete contact records into actionable intelligence by adding firmographics, demographics, technographics, and intent data to basic customer information

- Companies investing in enrichment see 20-30% higher conversion rates on enriched leads compared to raw leads, directly increasing pipeline value

- 25-30% of B2B data decays annually—continuous, automated enrichment is essential, not optional, to maintain data quality

- Modern enrichment architecture requires CDC pipelines for real-time updates, data warehouses (Snowflake/BigQuery) for centralized storage, and transformation layers (dbt) for data modeling

- Focus on strategic prioritization—enrich only the high-impact fields that directly fuel your ICP matching and sales plays to maximize ROI

- The data enrichment market is projected to grow from $5 billion in 2025 to $15 billion by 2033, reflecting its critical role in modern revenue operations

- Choose vendors carefully based on data quality, integration capabilities, and compliance—your enrichment strategy is only as good as your data source

Frequently Asked Questions About B2B Data Enrichment

Even with a solid plan, you’re bound to have some questions about putting B2B data enrichment into practice. Let’s walk through some of the most common ones I hear from teams just like yours.

Real-Time Versus Batch Enrichment

People always ask, “Should we enrich data in real-time or in batches?” The honest answer is: it depends on the job.

Real-time enrichment is fantastic for speed-to-lead. The second a new contact hits your CRM, it gets updated. This is a must-have for things like instantly routing hot leads to the right sales rep.

Batch enrichment, on the other hand, is your workhorse for bigger, less time-sensitive projects. Think of it like a scheduled deep clean for your entire database. It’s more economical and perfect for keeping your existing records fresh without breaking the bank. Most savvy teams end up using a mix of both.

How Does Data Enrichment Affect Data Privacy?

This is a big one, and it should be. With regulations like GDPR and CCPA, you can’t afford to get this wrong. The good news is that any data enrichment provider worth their salt has built their entire business around compliance. They know where their data comes from and have processes to handle user consent.

When you’re vetting a vendor, dig into their compliance story. A trustworthy partner will be an open book about how they source their data. This isn’t just about avoiding fines; it’s about building trust with your customers.

Choosing a compliant vendor isn’t just a best practice; it’s a fundamental requirement for protecting your business and your customers. An enrichment strategy must be built on a foundation of ethically sourced, privacy-compliant data.

Choosing the Right Data Vendor

Picking a data vendor can feel like a huge decision, but you can simplify it by focusing on three things.

- Data Quality and Coverage: Do they have the specific data you actually need? If you’re selling to a niche industry in Europe, a vendor with mostly US-based SMB data won’t cut it. Ask about their accuracy and how well their data maps to your ideal customer profile.

- Integration Capabilities: How well does it play with your current tools? A smooth connection to your CRM and data warehouse is non-negotiable. If the integration is clunky, you’ll lose all the efficiency you were trying to gain.

- Support and Partnership: You want a partner, not just a provider. Look for a team that will offer real advice and help you get the most out of their data, not just sell you a subscription and disappear.

At the end of the day, the best B2B data enrichment vendor is the one that feels like an extension of your own go-to-market team.

What’s the Difference Between Firmographic and Demographic Data?

Firmographics describe the company as a whole—industry, revenue, employee count, location. Think of it as “demographics for businesses.” Demographics zoom in on individual contacts within that company—their job title, seniority, department, and role in the buying process. You need both: firmographics tell you if a company is a good fit, demographics tell you who to talk to inside that company.

How Much Does B2B Data Enrichment Cost?

Pricing varies widely depending on the vendor, volume, and data types. Most providers charge per record enriched (typically $0.10-$2.00 per contact) or offer subscription tiers based on monthly enrichment volume. Enterprise solutions with real-time enrichment and premium data sources can run $20,000-$100,000+ annually. For smaller teams, tools like Clearbit or ZoomInfo start around $1,000-$3,000/month. The key is calculating your cost-per-enriched-lead against the lift in conversion rates to ensure positive ROI.

Which Data Enrichment Vendors Are Best for SaaS Companies?

For SaaS companies, the top vendors include Clearbit (great for tech stack data and real-time enrichment), ZoomInfo (massive B2B database with strong SaaS coverage), Apollo.io (affordable with built-in prospecting), and Clay (flexible data aggregation from multiple sources). If you’re targeting enterprise SaaS buyers, ZoomInfo’s depth is hard to beat. For startups on a budget, Apollo offers excellent value. The best choice depends on your ICP, budget, and integration requirements with your existing CRM and marketing automation tools.

How Do I Measure Data Enrichment ROI?

Track these four metrics before and after implementing enrichment: Lead-to-Opportunity Conversion Rate (enriched leads should convert 20-30% higher), Time to Qualify Leads (should decrease by 30-50%), Sales Pipeline Velocity (deals should progress faster with better context), and Marketing Engagement Rates (email opens and click-throughs should improve with personalization). Calculate your total enrichment cost (subscription + implementation + maintenance) against the incremental revenue from improved conversion rates. Most teams see 3-5x ROI within the first year.

What Are the Risks of Using Low-Quality Data Sources?

Low-quality data sources create more problems than they solve. Inaccurate enrichment leads to wasted sales effort (reps chasing wrong contacts), damaged sender reputation (emails bouncing or going to spam), poor segmentation (campaigns targeting the wrong audience), and compliance violations (outdated consent records violating GDPR/CCPA). Bad data compounds over time—your team loses trust in the CRM, stops updating records, and decision-making suffers. Always vet vendors for data accuracy (ask for match rates and decay metrics) and ethical sourcing practices before committing.

Can I Enrich Data Already in My CRM, or Only New Leads?

You can—and should—enrich both! Retroactive enrichment of your existing CRM database fills gaps in historical records and updates outdated information. This is typically done as a bulk batch process to refresh your entire database. Prospective enrichment handles new leads as they enter your system, either in real-time (as soon as they submit a form) or via scheduled batch jobs. Most teams start with a one-time database cleanup to establish a baseline, then maintain quality with ongoing enrichment of new records and periodic refreshes of existing ones.

How Often Should I Refresh My Enriched Data?

It depends on how fast your target market changes. For most B2B companies, refresh high-value accounts quarterly (decision-makers change jobs, tech stacks evolve, funding rounds happen) and your full database annually. For fast-moving industries like tech startups, consider more frequent updates—every 90 days at minimum. Prioritize refreshing records that are actively in your sales pipeline or recently engaged with marketing campaigns. Implement automated triggers to re-enrich records when key events occur (like a contact changing companies in LinkedIn, which many enrichment providers can detect).

Ready to stop wrestling with data pipelines and start seeing results? RevOps JET provides on-demand revenue operations engineering to build, manage, and scale your data infrastructure, saving you hundreds of hours. Get started at https://revopsjet.com.