Revenue forecasting models are essentially structured ways of predicting future sales. They take all your historical data, sales pipeline activity, and market trends, and turn that messy pile of information into something you can actually use to make smart decisions. We’re talking about everything from hiring and budgeting to those big strategic bets.

Why Revenue Forecasting Is Your Business Compass

Imagine you’re captaining a ship. You know where you want to go—growth, profitability, maybe even market domination—but the sea is full of surprises. You’ve got shifting market demands, economic squalls, and competitors popping up like pirates. Trying to navigate that blind is just asking for trouble.

This is exactly where revenue forecasting models come into play. They act as your ship’s compass and weather radar, all rolled into one. Instead of sailing on gut feelings or wishful thinking, you get a data-driven look at what’s ahead, helping you spot both storms and clear sailing long before you get there.

Charting a Course for Growth

Good forecasting isn’t just a bean-counting exercise for the finance team; it’s a strategic tool that gets everyone rowing in the same direction. When you have a solid idea of the money coming in, you can answer some pretty important questions with confidence:

- Hiring: Can we actually afford to bring on five new sales reps next quarter?

- Budgeting: How much can we really put into that new marketing campaign without running the well dry?

- Inventory: Should we stock up on materials now to get ahead of the seasonal rush?

- Investment: Is this the right year to invest in that new tech or finally expand into Europe?

Without a forecast, you’re just gambling with these decisions. A reliable model gives you the clarity to invest in growth, manage your resources wisely, and steer the company with a firm hand on the tiller.

It’s a bit shocking, but one study found that only 43% of sales leaders feel they can forecast with accuracy within a 10% margin. That’s a huge gap and it really underscores the need for better, more structured models that take the guesswork out of the equation.

Think of this guide as your navigation chart. We’ll start with the basic models that are the foundation of any good forecasting practice. Then, we’ll move into more advanced, AI-powered techniques that can find patterns you’d never spot on your own. The whole way through, we’ll keep it practical, helping you build a forecasting engine that delivers real results and moves your planning from reactive to truly proactive.

Exploring the Core Types of Forecasting Models

Picking the right revenue forecasting model is a bit like choosing the right tool for a job. You wouldn’t use a sledgehammer to hang a picture, right? In the same way, you wouldn’t rely on a simple historical average to predict revenue when your market is changing on a dime.

Each model gives you a different lens to look through when trying to see into your company’s future. Let’s walk through the main types, starting with the most straightforward and building up to the more sophisticated methods that dig into the why behind your numbers.

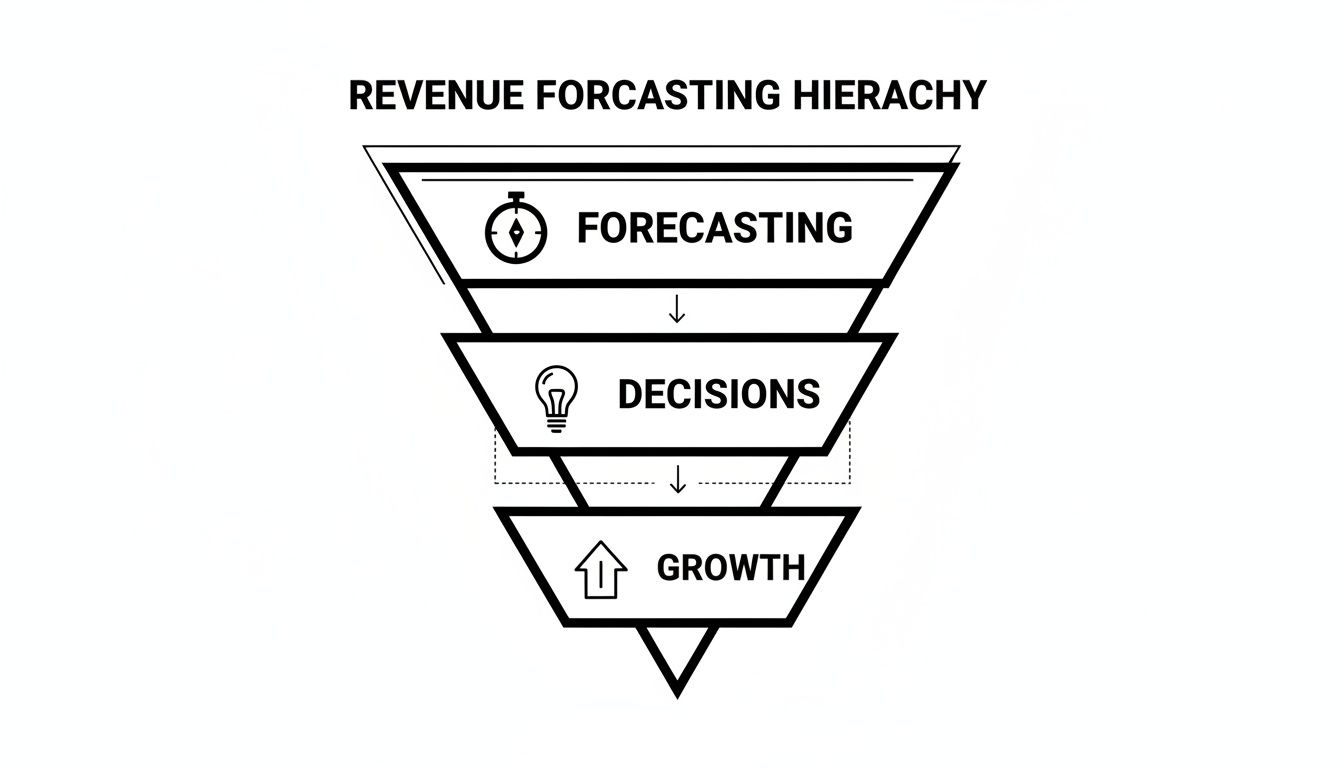

This whole process is about creating a solid foundation. As you can see below, forecasting is what guides your decisions, and those decisions are what ultimately drive growth.

Without a reliable forecast, your strategic decisions are just guesses. Nail the forecast, and you’re building your growth on solid ground.

The Foundation: Historical Averages

The most basic way to forecast is to simply look back. Think of it like predicting tomorrow’s weather by assuming it’ll be the same as today. It’s incredibly easy to calculate, but it can be thrown way off by any sudden shifts in the market.

A common starting point here is the moving average model. Instead of just grabbing last month’s revenue, you might average the past three or six months. This helps smooth out any random spikes or dips, giving you a slightly more stable—though still very basic—prediction.

- Core Concept: Uses past revenue data as the main predictor for what will happen next.

- Best For: Stable businesses with a long history of consistent growth and not much seasonality.

- Limitation: It’s completely blind to why revenue changes. A new marketing campaign, a competitor’s big launch, a shift in the economy? This model doesn’t see any of it.

Factoring in Time: Time-Series Analysis

Time-series analysis is a big step up from simple averages. It gets that revenue isn’t just a random string of numbers; it often follows predictable patterns over time. This is less like guessing tomorrow’s weather and more like a meteorologist looking at long-term climate trends and seasonal cycles to make an informed prediction.

This approach hunts for three key things in your data:

- Trend: The big-picture, long-term direction of your revenue (e.g., steadily growing by 5% every quarter).

- Seasonality: Those predictable ups and downs that happen at specific times of the year (like a huge sales spike every Black Friday).

- Irregularity: Random, one-off events that don’t fit a pattern (think a product going viral unexpectedly).

To really nail this, you need a good amount of data. Methods like ARIMA and exponential smoothing are most powerful when you have at least 24–36 monthly observations (that’s 2–3 years of data) to accurately map out those trends and seasonal swings.

Connecting the Dots: Causal Models

While time-series models are great at telling you what is likely to happen based on past patterns, causal models try to explain why. This approach directly connects your revenue to the specific business activities that influence it. It’s the difference between knowing it rains a lot in April and understanding that rain is caused by specific atmospheric conditions.

A causal model finds the mathematical link between revenue and the things that drive it. For example, it might figure out that for every $1,000 you spend on Google Ads, you generate $5,000 in new revenue.

This kind of model, often built with linear regression, is a game-changer for planning. If you know that getting your sales team to increase their demo calls by 15% leads to a 10% revenue bump, you can set real, actionable goals. Suddenly, your forecast isn’t just a passive prediction; it’s a tool you can use to actively shape your future. For more on this, check out our complete guide to sales forecasting techniques.

A Quick Comparison of Core Forecasting Models

To make it easier to see how these models stack up, here’s a quick snapshot. This table breaks down the complexity, data needs, and best-fit scenarios for each approach.

| Model Type | Core Concept | Data Requirements | Best For |

|---|---|---|---|

| Historical Averages | The future will look like a smoothed-out version of the recent past. | Minimal (a few months/quarters of past revenue). | Very stable, predictable businesses with no major changes. |

| Time-Series Analysis | Identifies trends, seasonality, and cycles in historical data to project forward. | Moderate (2-3 years of consistent data is ideal). | Businesses with seasonal patterns and clear growth trends. |

| Causal Models | Connects revenue to specific drivers (e.g., ad spend, sales headcount). | High (requires clean data on both revenue and its drivers). | Strategic planning and “what-if” scenarios. |

Ultimately, the best approach often involves a mix of these methods. By understanding the strengths and weaknesses of each, you can pick the right starting point for your business and build a forecast that’s both accurate and insightful.

How to Build Your Forecast from the Ground Up

A killer forecast doesn’t just appear out of thin air or from a fancy algorithm. It’s built on a bedrock of clean, relevant, and thoughtfully prepared data. Think of it like a chef prepping ingredients before cooking a masterpiece—your first move is always to gather and prep your raw data. If you skip this step, even the most sophisticated model will fall flat.

The journey starts with sourcing data from all corners of your company. Your CRM, like Salesforce, is the obvious first stop. It’s a goldmine of historical sales records, deal stages, and customer conversations. But a truly reliable forecast needs to look beyond just sales activity.

You have to pull in metrics from your marketing automation platform, your financial systems, and maybe even external sources. You need to ask yourself: what really drives revenue in our business?

- Marketing Data: What was our ad spend during our best quarters? Which campaigns brought in the leads that actually converted?

- Product Usage Data: If you’re a SaaS business, are there specific user engagement patterns that hint at a renewal… or churn?

- External Economic Data: Do things like interest rate hikes or dips in consumer confidence seem to line up with your sales cycles?

The Art of Feature Engineering

Once you’ve got all this raw data, it’s time for feature engineering. It sounds intimidating, but the idea is actually pretty straightforward. It’s all about transforming that raw data into more meaningful inputs—or “features”—that make your model way smarter.

Let’s stick with the chef analogy. A great chef doesn’t just toss whole vegetables into a pot. They chop, season, and combine them to create specific, delicious flavors. Feature engineering is the same concept; you take raw data points and combine or tweak them to uncover hidden patterns.

For instance, instead of just giving your model a “deal close date,” you could create a new feature called “is_end_of_quarter”. This simple yes/no flag might suddenly reveal a powerful tendency for reps to push deals over the line before a deadline—a crucial bit of wisdom your model can now learn from.

A model is only as good as the features it’s given. Strong feature engineering can often deliver a bigger accuracy boost than switching to a more complex algorithm. It’s about working smarter with the data you already have.

Here are a few other powerful engineered features you could create:

- Customer Lifetime Value (CLV): A combination of purchase history and frequency that helps predict a customer’s total future worth.

- Sales Cycle Length: The average time from lead creation to a closed-won deal, which you can calculate for different customer segments.

- Promotional Period Flag: A simple binary feature (yes/no) that notes whether a sale happened during a big marketing promotion.

Building a Reliable Data Pipeline

For anyone in RevOps, the real challenge isn’t just pulling this data once. It’s building a reliable, automated data pipeline that constantly feeds your forecasting model with fresh, clean information. A forecast running on old or incomplete data is often worse than having no forecast at all.

This usually means setting up a single source of truth—often a data warehouse like Snowflake—where all the data from your CRM, marketing tools, and ERP can live together. From there, tools like dbt can step in to transform and model the data, making sure your feature engineering is consistent and repeatable every single time the forecast runs.

Getting these connections right is fundamental. If you’re just getting started, you can learn more about the nuts and bolts of connecting these systems in our guide to data integration best practices. This is how you turn your forecast from a static, quickly outdated report into a dynamic and trustworthy tool for the entire business.

How to Measure and Validate Your Forecasting Model

Building a revenue forecasting model is one thing, but actually trusting its numbers is a completely different ballgame. Without a solid validation process, your forecast is really just an educated guess. I like to think of it like a weather forecast—you have to constantly check how its predictions actually stack up against what happened.

This validation process isn’t some final checkbox to tick off. It’s a critical feedback loop. It tells you whether your model is genuinely learning the right patterns from your data or just getting lucky. By rigorously testing its accuracy, you build real confidence and ensure your big strategic bets are based on solid ground, not shaky assumptions.

Key Metrics for Model Performance

To get a real sense of accuracy, you need the right tools. Think of these metrics as a report card for your model. While there are plenty of options out there, a couple are incredibly common and easy to wrap your head around when you’re just starting.

- Mean Absolute Error (MAE): This metric tells you, on average, how far off your predictions are in plain old dollars. If your MAE is $5,000, it means your forecasts are typically off by that much—either above or below the actual revenue. It’s a dead-simple way to understand the magnitude of your error.

- Mean Absolute Percentage Error (MAPE): This one measures the average percentage error. A MAPE of 8% means your predictions are, on average, within 8% of the actual revenue. This is fantastic for comparing accuracy across different time periods or even between business units of different sizes.

These two metrics give you a clear, quantitative answer to the most important question: “How wrong are we?”

The Power of Backtesting Your Model

If you take away one thing from this section, let it be this: the single most important validation technique is backtesting. The idea is simple. You pretend to go back in time, give your model only the historical data it would have had at that point, and see how well it predicts the “future” that has already happened.

This process helps you sidestep a massive pitfall called overfitting. Overfitting is like a student who crams for a test by memorizing the answers on a practice exam. They’ll ace that specific test, but they’ll completely bomb the final because they never actually learned the concepts and can’t handle new questions.

Backtesting forces your model to prove it can handle new information. By testing it on data it has never seen before, you simulate its real-world performance and ensure it has truly learned the underlying patterns in your business, not just memorized the past.

How to Structure a Backtest

Running a proper backtest means splitting your historical data into two separate buckets:

- Training Data: This is the bulk of your history (say, all your data from 2020 to 2022). You use this dataset to teach the model how your business drivers connect to revenue.

- Validation Data (or Hold-Out Set): This is a separate, more recent chunk of data (like all of 2023) that the model isn’t allowed to see while it’s learning. Once the model is trained, you use it to predict revenue for this period and then compare its forecasts to what really happened.

This separation is completely non-negotiable for building a model you can rely on. It’s the only way to get an honest, unbiased assessment of how good your model actually is at predicting the future. As you get more sophisticated, keeping an eye on your data’s integrity becomes critical. To learn more, check out our guide on what is data observability and see how it supports reliable analytics.

The Rise of AI and Machine Learning in Forecasting

Once you’ve squeezed all the juice you can out of traditional forecasting methods, it’s time to look at what machine learning can do. If historical and causal models are like using a map and a compass, ML forecasting is like having a GPS that reroutes you in real-time based on live traffic, accidents, and even your car’s fuel level. It’s a completely different league of predictive power.

These sophisticated revenue forecasting models don’t just look for simple, linear relationships. They’re built to find the messy, complex, and often hidden patterns that simpler methods just can’t see. They can analyze how dozens of variables—from website clicks to the sentiment of a sales call—all interact to push a deal over the finish line.

This is where you start hearing about powerful algorithms like XGBoost or Random Forest. These are incredible tools, but they’re best suited for companies that already have a solid data foundation and are looking to find that next competitive edge in their forecasting accuracy.

Going Beyond Simple Predictions

Just think about all the little things that might influence a sale. Of course, you have the big ones: deal size, sales cycle length, and the buyer’s seniority. But what about seasonality, a competitor’s surprise product launch, or a subtle shift in the economy?

An ML model can chew on all of this data at once. It learns from every single interaction, figuring out which specific combination of factors leads to a win. For businesses sitting on a mountain of data, this is an absolute game-changer.

The real magic of AI isn’t some unknowable intelligence; it’s scale. A machine learning model can test thousands of different hypotheses about your data in seconds—something a human analyst could never do. This is how it uncovers powerful predictive signals that are otherwise invisible.

For instance, an ML model might learn that deals involving a product manager are 30% more likely to close, but only if the first demo happens within the first week of a new quarter. Good luck finding that kind of nuance with a simple regression model.

The Trade-Off: Accuracy vs. Complexity

All this power doesn’t come for free. While ML models can deliver jaw-dropping accuracy, they are far more complex to build, maintain, and—most importantly—understand. This leads us to the classic “black box” problem. Sometimes, the model is so intricate that it’s nearly impossible to pinpoint exactly why it made a certain prediction.

That can be a tough pill to swallow for executives who need to trust the numbers they’re seeing. When a model predicts a 15% drop in revenue, the first question from your CEO will be, “Why?” Answering with “Because the algorithm said so” is a great way to lose credibility fast.

As many practitioners have found, techniques like gradient boosting and random forests are fantastic for capturing these complex relationships between predictors and revenue. However, as detailed in guides on applying ML to forecasting, they require a ton of data and rigorous validation to prove they’re actually better than simpler models.

Making the Black Box Transparent

Thankfully, we’re not stuck guessing. A growing field called explainability is giving us the tools to crack open the black box. Techniques like SHAP (SHapley Additive exPlanations) are designed to show us which factors had the biggest impact on a forecast.

Here’s how they help:

- SHAP Values: These tools can take a single prediction and show you precisely how much each feature—like “deal size” or “sales rep experience”—pushed the final number up or down.

- Feature Importance: This gives you a bird’s-eye view of the most influential variables across the entire model, helping you gut-check that it’s focusing on the business drivers that make sense.

By bringing explainability into the process, you get the best of both worlds: the raw accuracy of advanced revenue forecasting models and the clear, understandable insights you need to build trust. This turns the technology from a mysterious oracle into a transparent, powerful partner in your strategic planning.

Putting Forecasting Models to Work for SaaS and Sales Teams

Theory is one thing, but let’s get down to brass tacks. How do we turn these models into something that actually helps a sales-driven or SaaS business? These companies operate with unique rhythms—recurring revenue, long deal cycles—and need forecasts that reflect that reality. The goal isn’t just to land on a number; it’s to build a model that tells a compelling story about your company’s momentum.

For most sales teams, the most practical place to start is with a pipeline-based forecast. This is a classic bottom-up approach. You look at every single deal currently sitting in your CRM and calculate its likely contribution to your future revenue. Think of it like a factory manager counting the cars on an assembly line to predict how many will be finished by the end of the shift.

This method is king in enterprise and SaaS sales, where each deal has a journey. You assign a probability to every opportunity based on its sales stage, using your own historical win rates as a guide. That weighted value gives you a much more grounded view than just wishfully adding up every deal in the pipeline. You can dig into how different companies apply these probabilistic models to their sales pipelines on maxio.com for more examples.

Building a Weighted Pipeline Forecast

Creating a weighted pipeline forecast is a game-changer. It immediately injects a dose of reality into your predictions because you’re not just guessing—you’re using your own track record to predict the future.

Here’s a simple way to get it done:

- Dig Into Your Historical Win Rates: Pull the data from your CRM for the last 12 months. Of all the deals that made it to the “Proposal Sent” stage, how many actually closed? Run this analysis for every single stage in your sales process.

- Assign Probabilities to Each Stage: Your data might reveal that deals in the early “Discovery” stage have a 10% chance of closing, while those in the final “Negotiation” stage have a 75% win rate. These become your stage probabilities.

- Calculate the Weighted Value: Now, take each open deal and multiply its potential value by the win-rate probability of its current stage. So, a $50,000 deal that’s in negotiation has a weighted forecast value of $37,500.

A great pro-tip is to combine this bottom-up, deal-by-deal analysis with a top-down historical model (like a simple moving average). Your weighted pipeline can act as your “expected case,” while the historical model provides a “best-case” or “worst-case” scenario, giving you a powerful forecasting range to work with.

How to Adapt Forecasting for SaaS Businesses

For a SaaS company, a standard sales forecast only tells half the story. Your real growth engine is recurring revenue, so your model has to account for the entire customer lifecycle—not just the initial sale.

A truly robust SaaS forecast is actually a combination of several smaller forecasts. It needs to include:

- New MRR: This is the Monthly Recurring Revenue you bring in from brand new customers. A pipeline-based model is perfect for forecasting this.

- Expansion MRR: This is the extra revenue from existing customers who upgrade, add more seats, or buy new products. You can forecast this by looking at historical upsell rates.

- Churn: This is the revenue you lose when customers cancel. It’s absolutely critical for getting an honest picture of your net revenue growth.

By building separate, dedicated mini-models for new business, expansion, and churn, you can then roll them all up into one comprehensive and far more accurate forecast. This layered view shows you exactly where your future revenue is coming from, helping you make smarter decisions on everything from hiring new sales reps to investing more in your customer success team.

Common Questions About Revenue Forecasting

Jumping into revenue forecasting can feel daunting, but trust me, the strategic clarity you gain is worth every bit of effort. Over the years, I’ve seen countless RevOps leaders and analysts run into the same hurdles. Let’s walk through some of the most common questions I hear to help you get started on the right foot.

The biggest mistake I see is trying to over-engineer things from day one. Your first model doesn’t need to be some sort of AI-powered crystal ball. The real goal is to build a solid, reliable baseline that you can actually trust and then iterate on.

Which Model Should I Start With?

For most companies, the best way to begin is by combining a simple historical model with a pipeline-based forecast. This two-pronged approach is incredibly effective because it gives you a balance of perspectives. The historical data gives you a top-down view of what’s happened before, while your pipeline analysis offers a bottom-up look at the deals you’re working on right now.

This blend creates a realistic forecasting range. Think of your historical average as your floor, or a “worst-case” scenario, and your weighted pipeline as the more optimistic “expected case.” It’s practical, easy to explain to your leadership team, and built on the CRM data you already have.

The most effective first step is often the simplest. Start by calculating your historical win rates by sales stage. This single exercise will immediately bring a new level of data-driven reality to your pipeline discussions and forecast.

What If I Have Limited Historical Data?

This is a classic problem for startups or for teams launching a new product. When you don’t have years of data to fall back on, you have to get a little creative. Your focus needs to shift from long-term trends to the immediate, activity-based drivers you can actually measure.

Here’s what you can do:

- Driver-Based Forecasting: Build a simple model that links specific sales activities—like demos completed or proposals sent—directly to revenue outcomes.

- Market Research: Don’t operate in a vacuum. Look at industry benchmarks. What are the typical sales cycles or conversion rates for companies like yours?

- Sales Team Input: Talk to your reps. Their qualitative insights and on-the-ground knowledge are pure gold when you’re short on hard data.

When Is It Time to Upgrade My Model?

You’ll get a gut feeling when your current model is no longer cutting it. The biggest sign is when it consistently misses the mark or can’t help you understand why things are changing. If your forecasts are regularly off by more than 10-15%, or if you can’t answer questions like “how will this new marketing campaign affect our Q3 number?”, it’s time for an upgrade.

Moving to a more sophisticated causal or machine learning model isn’t about chasing buzzwords. It’s about a real business need for deeper, more accurate insights to steer bigger, more complex decisions.

Building and maintaining these advanced models requires serious engineering. RevOps JET provides the technical expertise to design, build, and manage the production-grade data pipelines and infrastructure your forecasting depends on. See how our dedicated RevOps engineers can save you hundreds of hours at https://revopsjet.com.